Getting fuel measurements wrong can be costly. In 1983, an Air Canada Boeing 767 famously ran out of fuel 41,000 feet above Ontario because its ground crew had confused pounds with kilograms during refuelling.

The captain landed the plane safely. But the incident is one of many similar cases underlining why bad measurements make for bad calculations.

We can see how the same issue affected hundreds of thousands of company car and car allowance users over the last five years.

The Advisory Fuel Rates (AFRs) for reimbursing company car fuel used over-optimistic mpg figures for years. As a result, they were in some instances up to 40 per cent lower than the average driver’s actual fuel cost.

Our analysis for a forthcoming white paper on fuel reimbursement options points to HMRC’s base fuel consumption data as the culprit. Bad measurements make for bad calculations.

As TMC has reported several times, mpg figures derived from the previous official (NEDC) fuel consumption and CO2 test were less and less trustworthy as time went on. By 2016, real-world mpgs of cars on TMC’s Mileage Capture system were typically 29% lower than the official figure.

That is twice the difference that HMRC allows for when it calculates the AFRs using official fuel consumption figures.

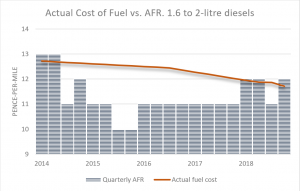

The chart below shows what this meant for drivers of two-litre diesel company cars between 2014 and 2018.

The vertical bars are the AFR rate. The line is the average real-world pence-per-mile cost of diesel fuel for 10,000 diesel cars in the TMC Mileage Capture and fuel database. Note that the price of diesel in the second half of 2014 was almost the same as in late 2018: the fall seen in actual fuel costs was due to average real world mpg increasing from 45.7 to 49.6 over the period.

Despite rising fuel economy and falling fuel prices between 2015 and mid-2018, the AFR paid significantly less than fuel real cost. At one point the AFR was 25 per cent below the average real cost for drivers of 2-litre diesels and (not shown) 45 per cent below the average for drivers of 1.6 litre diesels. The rate only caught up with drivers’ actual costs in June 2018.

Depending whether companies used the AFRs to deduct for private fuel or pay for business miles, one side or the other potentially lost hundreds or even thousands of pounds per car each year.

Though the transition from NEDC to the new WLTP emissions procedure after 2017 was not easy, the WLTP test produces more realistic – i.e. higher – official fuel consumption figures. So HMRC’s calculation method should now produce more realistic AFR rates on average.

But the AFRs still exhibit flaws associated with flat-rate payments. They are never fair to all drivers. They constantly get out of line with pump prices – even with quarterly adjustments. They are ‘lumpy’ because they have to move up or down by 8-10 per cent at a time. And they supply almost no management information.

The AFRs are still popular despite these drawbacks, but at TMC we now see more fleets looking at Actual Cost reimbursement driven by capture of fuel and mileage data. It is fair and it almost invariably saves companies money because they can see their costs clearly and they are working with good measurements instead of ‘one size fits all’.