In a nutshell, Mileage+ reduces your fuel bills by accurately recording and auditing your employees’ business mileage and fuel expenditure.

Our award-winning Mileage Capture and Audit service starts with an easy to use mobile app that logs drivers’ mileage whilst on the go. We can also take a telematics feed or alternatively, drivers can input their business trips via our online system. We audit every journey and ensure compliance with your company policy.

At the end of each month, drivers submit their final odometer reading and we provide a payroll file for reimbursement/private mileage deductions where fuel cards are used. For electric vehicle drivers, we provide the reimbursement due for domestic electricity used to charge the vehicle and/or public charging.

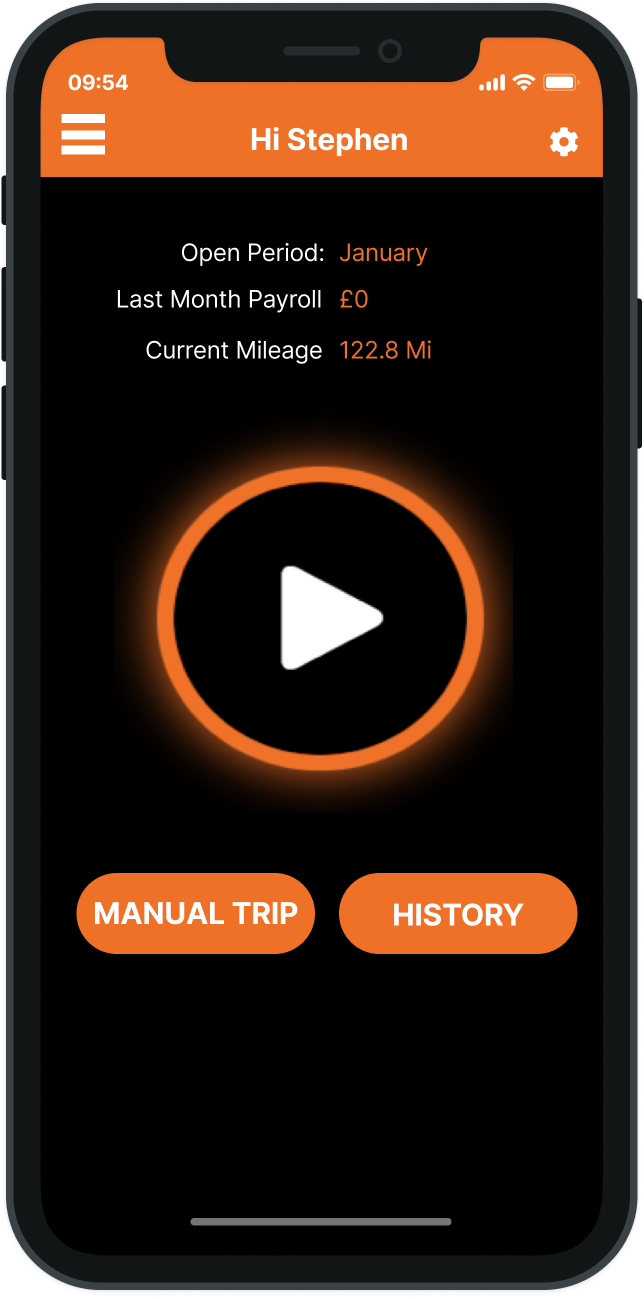

The Mobile app

We’ve made drivers’ lives even easier with ‘Mileage Track’, our mobile app that uses GPS to track journeys and load them directly into the mileage capture system. With no need to connect to a PC, and with the ability to upload fuel/public charging receipts by taking a photo through the device’s camera, logging mileage couldn’t be easier for your drivers.

The real benefits to your business are:

- Cost savings

- Less administration

- Insightful consolidated reporting and information

- Compliance – full and accurate mileage records for tax purposes

The Audit

Our audit process typically reduces the cost of mileage claims by an average of 15.4%. Our system uses complex algorithms and highlights when things don’t quite match up. The employee will be asked to explain any discrepancies in mileage against our postcode look up, which will be reviewed by our Employee Service team, who will contact the driver to find out more information where necessary.

This process not only works to highlight and correct the discrepancies, but it further works as a deterrent, to stop drivers exaggerating their claims.

What reporting is included?

Payroll

Our Mileage Audit system streamlines reimbursements and repayments, by providing you with a payroll file which you can easily use to deduct private mileage or reimburse business mileage. For drivers of electric vehicles, we can work out a pence per mile at cost.

The audit system works equally well for company vehicles, cash allowance and grey fleet drivers.

Management

We hold so much valuable data about your fleet that it enables us to produce a range of management information reports to help you further manage your fleet’s fuel spend, CO2 emissions and driver safety. We do this by looking at the below data:

- Vehicles

- Journeys made

- Miles driven

- Fuel spend

- Fuel consumption

Mileage+ is at the heart of TMC’s services. We can use the data collected by the Mileage Track app to help manage your occupational road risk. We can also help you with your EV strategy by using real world data about your fleet to help with the transition to electric.

Do your employees use rental vehicles?

If so, you may be interested in our Rental Audit service. TMC can audit your vehicle rental usage and mileage to give you visibility and reduce costs.

Our service checks the length of the rental to prevent excessive rental days (no hiring on a Friday for a Monday trip), audits the business trip to check mileage, provides a quick, easy reimbursement method for business mileage and collates all the information to report back via our interactive online dashboard