From 2023, BIK percentages will be dependent on CO2 emissions as well

as mileage.

Employees provided with a company car which is made available for private use are liable to pay tax on the Benefit in Kind, known as a Notional Pay. The Notional Pay is based on the “cash equivalent” of the private use, which is currently determined by the annual business kilometres driven and the “Original Market Value” (OMV) of the vehicle.

The new rules that come into play as of January 2023 mean that BIK amounts will be

determined by not only the business mileage undertaken in the vehicle but also the

vehicle’s CO2 emissions.

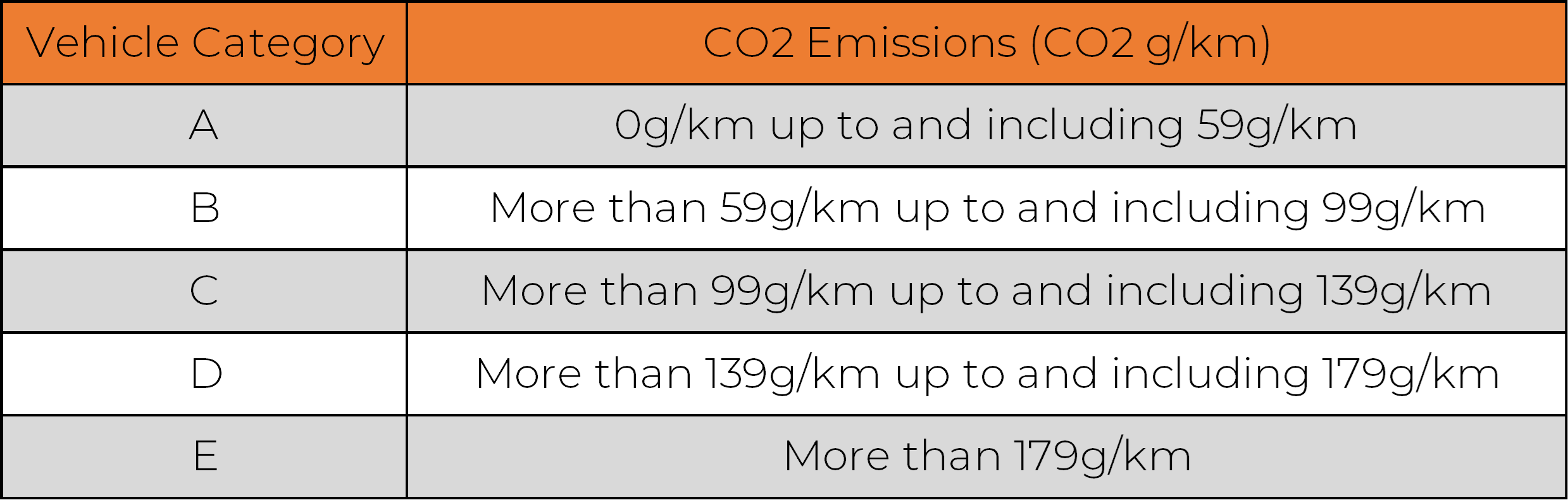

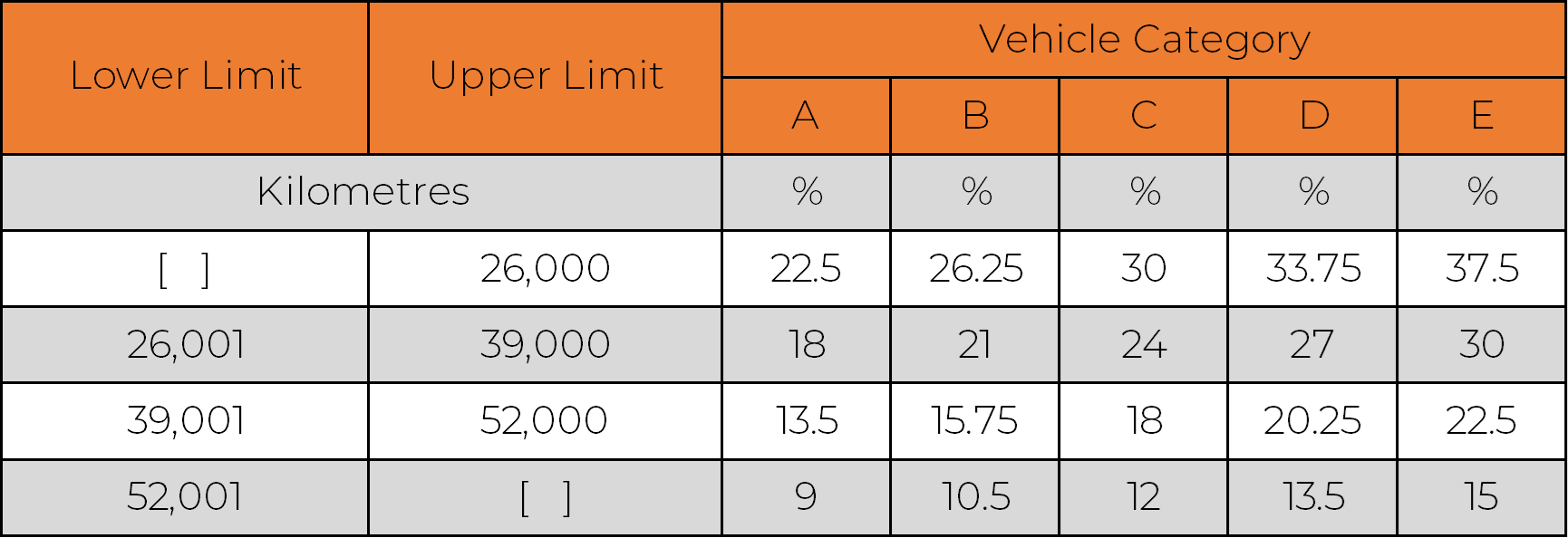

Please find details in the table below:

i. The CO2 emissions category of the car is as per the following table

ii. The amount of business mileage and CO2 emission category

Employers are required to maintain records of the kilometers travelled by each employee. This should be maintained on a weekly/monthly basis in order to calculate the BIK to be reported on a real time basis via the weekly/monthly payroll returns. The revenue have advised that employers should review this regularly (at least quarterly) to ensure the BIK recorded is as accurate as possible.

How can TMC help?

Through implementing TMC’s services, both the company and the employee can

benefit from the following:

- TMC enable employees to report their mileage data easily with use of the TMC

Mobile App or Online Mileage Capture Tool ensuring mileage is reported accurately and frequently. - The Service reduces administration; all data collection and Notional Pay calculations are processed monthly by TMC.

- Full visibility of fuel costs, associated fleet data, and audit records (should it be

required to provide evidence for an internal or external audit) provides customers with the ability to make future informed cost saving decisions. - Reporting mileages on a monthly basis reduces the requirements of any year-end

adjustments where the employee would then be at less risk of a big tax bill at the end of the year. - TMC can also produce payroll reimbursement files where employees are

reimbursed for their mileage at Civil Service rates and company rates dictated by policy. - The fuel versus mileage audit ensures that employees are stating their business

mileage correctly, not using their fuel cards to fill additional vehicles and are mindful of being more fuel efficient.