The Cost of Providing BIK fuel

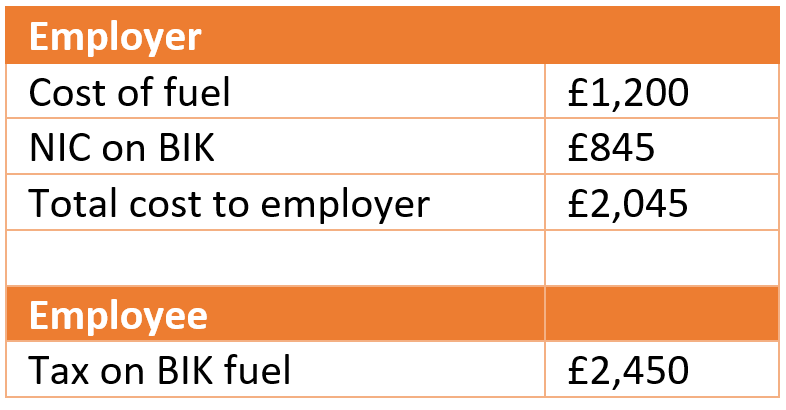

The example below is based on a 40% tax payer driving 10,000 private miles in a company car with 25% BIK.

Tax on the fuel BIK is £2,450 which is equivalent to 20,417 private miles of fuel at 12ppm. So the driver would need to do over 20,417 private miles for free fuel to be financially beneficial.

If only 10K private miles are driven, removing free fuel could save over £4K to the employer, or the saving could be split between employee and employer.

Fully Expensed Fuel

Read how we helped Lyreco achieve big savings.

For the few drivers who genuinely benefit from free fuel, we can help you deliver it in a more cost effective way.

It’s not too late to make the saving for this tax year. But employees will need to repay the cost of their private fuel before 6th July 2021.

For more information, please get in touch with us using the contact details or form below. We’d love to help you.