Fully Expensed Fuel

With some estimates of average annual mileage dropping as low as 5,500 in 2020, very few employees will benefit from BIK fuel this tax year.

At a time where every cost is under the microscope, now could be a good time to look into what ‘free fuel’ is costing the business and whether it is providing any benefit to employees.

TMC can help!

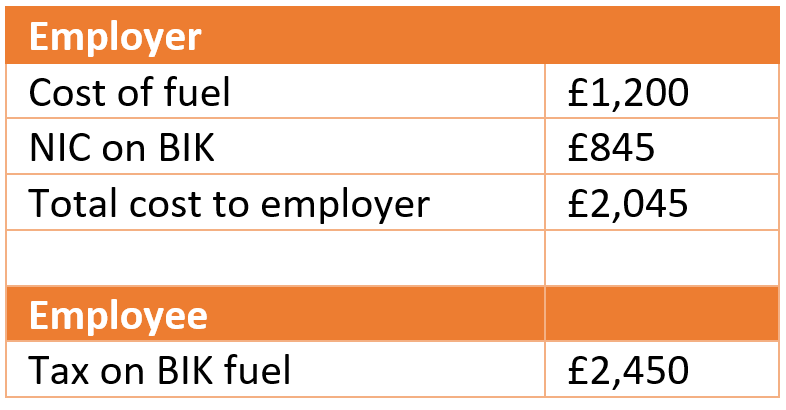

Our analysis of a typical driver receiving ‘free fuel’ has shown it could be costing the employee and business more than £3,000 in tax alone.

Cost of Providing BIK fuel

The example below is based on a 40% tax payer driving 10,000 private miles in a company car with 25% BIK.

Tax on the fuel BIK is £2,450 which is equivalent to 20,417 private miles of fuel at 12ppm. So the driver would need to do over 20,417 private miles for free fuel to be financially beneficial.

If only 10K private miles are driven, removing free fuel could save over £4K to the employer, or the saving could be split between employee and employer.

How TMC can help

Amending or removing a perceived benefit can be a tricky process, but we can provide individual statements to each employee to show what their ‘free fuel’ costs them in BIK tax compared to the cost of the fuel used for private mileage. We are also on hand to answer any questions your employees have and talk through the figures.

For most employees, this will highlight that they will better off opting out. As per the example above, in our experience, most drivers’ private mileage is considerably below the cost of their BIK and this situation will be further amplified during the pandemic.

Even if private mileage begins to increase again, significant savings will still be available.

Read how we helped Lyreco achieve big savings.

For the few drivers who genuinely benefit from BIK fuel, we can help you deliver it in a more cost effective way.

It’s not too late to make the saving for this tax year. But employees will need to repay the cost of their private fuel before 6th July 2021.

For more information, please get in touch with us using the contact form or details below, we’d love to help you.