Meet Stephen.

Stephen uses his own vehicle when travelling on business.

The business he works for appointed TMC to manage their grey fleet.

Stephen uses his own vehicle when travelling on business.

The business he works for appointed TMC to manage their grey fleet.

Stephen receives an email from TMC, explaining our services and providing log in details for his TMC account.

When Stephen logs into his TMC account for the first time, he is taken through an onboarding process that asks him to provide details of his vehicle, licence and insurance.

This service is called Compliance+ and the process is easy.

Stephen is asked to scan his driving licence via the app using the camera on his smartphone, he then inputs his vehicle registration which prompts an automatic check to verify the vehicle is taxed and MOT’d.

Stephen is prompted to take a picture of his Insurance Certificate which he can upload to his account via the app or PC. TMC’s Specialist Audit Teams then validate and confirm that the vehicle is covered for business use.

Finally, Stephen is presented with an electronic copy of the company fleet policy and a number of duty of care statements. Once he has read and accepted them, Stephen can then proceed to begin recording his mileage.

Stephen uses the TMC app to record his business trips via GPS. He has set the app to record his journeys Monday – Friday 0800 – 1800. Stephen takes pictures of his VAT fuel receipts and uploads the images to support his mileage claims.

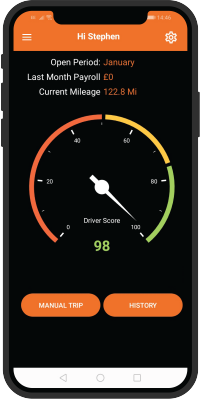

Each journey Stephen does is scored out of 100 using data from the device’s in-built accelerometer, gyroscope and GPS. This enables TMC to report on Stephen’s speeding, acceleration, braking and cornering.

An average is displayed on the dashboard of Stephen’s app, as well as being reported back to the business.

Our system uses complex algorithms and highlights when things don’t quite match up. Stephen will be asked to explain any discrepancies in mileage against our postcode look up, which will be reviewed by our friendly Employee Service team, who will contact Stephen to find out more information where necessary.

This process not only works to highlight and correct the discrepancies, but it further works as a deterrent, to prevent drivers from exaggerating their claims.

At the end of each month, Stephen’s line manager receives a notification to log into their TMC account and review Stephen’s mileage claim.

Once approved, TMC produces a payroll file using the business mileage on Stephen’s account to enable reimbursement. Stephen’s company reimburse him for his business mileage.

A supporting VAT report is also created by TMC to allow the company to recover the VAT paid on Stephen’s mileage.

Our Mileage Capture and Audit solution could be perfect for you! Take a look at our video which walks you through the process, involving the points explained above.

We gain so much valuable data about your fleet and drivers, which we report back to you in the form of an online dashboard.

This will hold all the duty of care information – driving licence checks, MOT, Tax and Insurance information and confirmation that Stephen has agreed to adhere to your fleet policy. Stephen’s driver behaviour scores will also be reported back.

TMC schedule checks for Stephen’s driving licence, MOT, Tax and insurance to ensure he is always covered to drive on business.

Stephen drives a petrol vehicle.

If he were to drive an electric vehicle, Stephen’s experience above would be the same. He would just need to provide information on his tariff and any public charging receipts for us to work out his reimbursement rate. You can read more on reimbursement for electric vehicle drivers here.

Our industry leading app accurately records mileage whilst being easy-to-use and driver friendly.

Visa to Drive uses TMC’s software along with our team of expert auditors to collect, collate and verify your employees’ documentation to fulfil your duty of care obligations