NIC savings for both employee and employer

If your business offers drivers a cash allowance rather than a company car and reimburses business mileage at a rate less than the HMRC approved AMAP rates, TMC could help you make savings

Cash iQ gives employees and the company the opportunity to enjoy the maximum NIC exempt amounts that HM Revenue & Customs (HMRC) allow where employees use their own vehicle for business. These are known as Relevant Motoring Expenses (RMEs).

The service uses employees’ business mileage claims to calculate the NIC disregard available on a monthly basis, attracting savings for both the employer and employee.

Employees can also benefit from receiving Mileage Allowance Relief (MAR) annually via a P87 claim or self assessment tax return.

On the back of the recent rulings found in favour of taxpayers and exposing HMRC to further cash allowance claims, companies with employees in cash allowances who are reimbursed for business mileage at a rate less than the HMRC approved AMAP rates (45p for the first 10,000 miles, 25p thereafter) should be eligible to benefit from immediate savings for the current tax year and consider making a protective claim for the last six tax years!

How does it work?

Employees record their business mileage monthly and are reimbursed for fuel (and/or repay private fuel if using a fuel card) in the usual way.

TMC then use the business mileage claims to calculate the value of Relevant Motoring Expenses available to reduce the monthly car allowance in return for NIC-free payments. TMC ensure that any variations in business mileage are treated correctly for NIC and maximise the value of the allowances available.

How is it calculated?

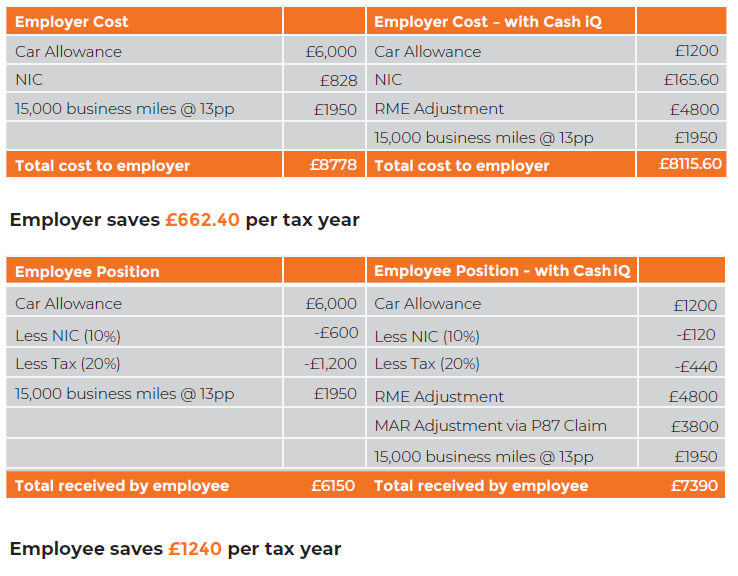

TMC will provide you with a simple payroll file for the adjustments. The tables below show how the calculation works and demonstrate the savings the employer and employee can make from Cash iQ.

The example is based on a 20% rate taxpayer with a £6,000 per annum car allowance driving 15,000 business miles per annum with a reimbursement of £0.13 per mile.

Savings Example